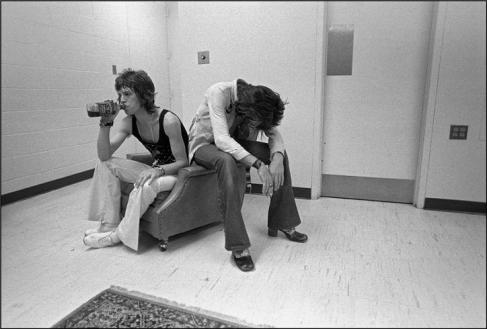

Mr. Michael Philip Jagger, shown left, and his sidekick, Mr. Keith Richards, at right, contemplate the perils of international high finance in America, whilst touring there, circa 1972.

In 1972, the, then hopelessly young, Sir Michael Philip “Mick” Jagger (ne 26 July 1943, Dartford, Kent, England) OBE, an English musician, singer, songwriter and actor, best known as the lead vocalist and a founder member of The Rolling Stones, sang to us to “call me the tumblin’ dice—you gotta roll me.” Mr. Jagger’s precise meaning in 1972 when he sang us this tune was obscure, but I am sure that he would agree that the Americans are, today, as little more than tumblin’ dice, at Wall Street, in New York City, America’s very first capital city. As Mr. Jagger’s home of birth, Her Majesty’s Elizabeth’s England, is further on the road to fiscal ruin than is America, Mr. Jagger took from Her Majesty his Order of The British Empire, genuflected, and got the hell out of England, first to south of France and now, we are told, in late repose, to my dear Mother’s home of birth, north Italy—a sunny, temperate, clime to which any peer, lifetime or hereditary, of the Empire would be happy to repair and live out his waning days.

My dear friend, Mr. Hedrick Smith, in his masterwork, Who Stole the American Dream, is doubtless correct that the mortgage de-leveraging bubble of the decade preceding the Great Panic of 2008 was caused principally by two factors: The decades-long stagnation of real dollar US wages and the conscious flirtation of an American banking industry set upon seducing the Americans to take second trusts and other suspect financial options to access capital, at cheap rates, because, absent any real hope of making money at their jobs, the equity in their homes was the only true liquidity most Americans possessed.

Mr. Jefferson, as early as 1796, wrote to Mr. Madison that Mr. Hamilton and his cronies at New York, had turned “America into a giant gaming table on which the citizens are but cards and tumbling dice.” We ask: does anything ever really change as to the fundamentals of man’s folly? Perhaps, Mr. Jagger can sing us a sequel song.

As we now know, a great number of Americans succumbed to the enticement of the bankers and those Americans will bitterly rue having bedded down with the bankers—a lament they will, doubtless, carry with them for the rest of their lives. A girl must be very careful of her reputation—most particularly around bankers–as these men can “talk real pretty,” as we used to say in the southland, but in the morning after, a girl is ruined for life.

To save the Nation from complete wreak and ruin in the ensuing wake of the Panic of 2008 brought on by this, serial seduction, of the Americans by the bankers, young Mr. Bush and his successor poured un-Godly sums into Wall Street in what has been come to be called, and most unpopular so, “the Wall Street bailouts.”

Both young Mr. Bush and his successor likely felt that given the fear engendered by the Panic of 2008, pouring money into Wall Street banks was the only way to save this land.

Be that as it may, I am not alone in asking: what about Main Street? What about actual live citizens? Huge sums were disbursed in these bailouts, but none actually reached the Main Streets of America, which remain, at this late hour, in fiscal exile. Nor did the money reach the American people, the, by myself, presumed, intended end recipients of the bailouts.

So Wall Street remains awash in cheap capital and, as the bailouts are given without stipulation as to use, Wall Street has done with the bailout money precisely what Wall Street is paid to do—seek out the best return on equity from the money at hand, notwithstanding that this particular money arrived gratis from the public till.

Specifically, Wall Street was back in a flash to its old habits—back to Leveraged Buy Outs, LBOs, Mergers and Acquisitions, M&As, credit risk derivative swaps—those worth an entire separate page, or yet more, to come soon to this theater, free for your viewing pleasure–and, let us not forget, private equities. We ask: What about Main Street and the clients on Main Street—who tends to their needs as they languish in exile? We would appreciate an answer to this but none appears apparently fast forthcoming from Washington or Wall Street.

Now, of course, the Americans are dispossessed of their sole equity source and the reverberations of the Panic of 2008 continue to quake through US and throughout the West. Sadly, The Americans, the light of the world, can, quite humbly, tell us now how it feels to be scroungin’ their next meal:

In the East however, things are very different, for now anyway. We will shortly see here that the situation in the East is fast about to change—radically so.

When I was first taught of money, I remember the premier adage whispered in my ears: “Johnnie, Johnnie, money always protects itself.” What this has meant as a practical matter for finance in the time since the Panic of 2008, and remains true as this is penned, is a massive flight of capital to the East, and more specifically to the BRIC nations–Brazil, Russia, India and China.

God, we are told, is just. As He is just, America will turn around. She will come back. What will that mean for the nations who have benefited from our Great Panic of 2008—those who have provided safe haven for skittish money from the West seeking, as always, to protect itself?

Let’s just say that when America comes roaring back, as she will; those nations are in for a bit of a jolt. Rather a large jolt, actually. So, we ask, is finance always zero sum—a scheme in which one must always lose for the other to win? We hope not, but then, there it is—all evidence suggests that finance is, in fact, a zero sum game.

Follows now, some startling thoughts about what happens when America and the West return to normal—whatever that might mean to the reader.

***We are thankful to Mr. Andrew Xie and Mr. Jesse Colombo for their contributions to this discussion quoted as follows until noted quoting ceased:***

As the U.S. economy recovers, a strengthening dollar might cause the next financial crisis, warns Singapore-based economist Andy Xie.

“The first dollar bull market in the 1980s triggered the Latin American debt crisis, the second the Asian Financial Crisis. Neither was a coincidence,” Xie writes for Caixin Online, a website specializing in China’s financial and business news.

When the dollar is in a bear market, liquidity flows into emerging markets, causing their currencies and asset prices to appreciate, which supports domestic demand.

“When the dollar changes direction, so does liquidity,” according to Xie, a former Morgan Stanley economist who predicted the economic bubbles like the 1997 Asian financial crisis and dot-com bubble.

“The virtuous cycle on the way up becomes a vicious one on the way down. The emerging economies already suffer inflation. The liquidity outflow leads to currency depreciation, which worsens inflation.”

When the dollar’s value falls, dollar debt tends to rise in emerging markets, as the weak dollar lowers debt service and encourages over borrowing. But when the dollar reverses course and strengthens, the debt burden becomes unsustainable.

“Hence, no lenders want to roll over the loans anymore,” Xie explains. “A liquidity crisis ensues. This is what occurred in Latin America in the 1980s and Southeast Asia in the 1990s.”

The BRIC countries (Brazil, Russia, India and China) are bubbles ready to pop, he warns.

“Whenever there is a hot concept like BRIC, there is a bubble. There has never been an exception,” Xie writes. “The BRIC countries exhibit all the symptoms of binging on cheap credit: high levels of indebtedness, inflation and strong currencies.”

The BRIC countries have seen inflows of foreign capital dissipate, and they are much like Southeast Asian countries just before the 1996 crisis. A wrong policy move could prompt a “full-blown financial crisis.” The right move for the BRICs is to raise interest rates to tighten money supply now.

But don’t count on that. They seem more interested in sustaining short-term growth, Xie says. “Some emerging market turbulence is quite likely within the next 24 months.”

Emerging markets like the BRICs, fueled by hot money from abroad, are bubbles waiting to collapse, agrees Jesse Colombo, an independent analyst and trader.

“Global investors, seeking to diversify away from the post-bubble heavily-indebted Western world, have inadvertently created a massive ‘hot-money’ bubble in emerging market nations, causing overheated economies and property bubbles everywhere from Brazil to Israel to the Philippines,” he writes in an article for Seeking Alpha.

***We are thankful to Mr. Andy Xie and Mr. Jesse Colombo for their contributions to this discussion quoted above and, now noted, quoting ceased:***

Can prosperity ever be universal? Is this too much to ask? Must one sector always lose for the other to win? By this we mean both here at home and abroad—is a universal prosperity a possible end? We pray yes, but we wonder here just how to reach that land of milk and honey flowing for all peoples.

We don’t know. What we do very much know is that what we want here in America is a more equitable distribution of financial assets, specifically to include—and primarily so—Main Street and the live, sensate, Americans who actually live there, now in exile, as against Wall Street and Washington, places at which the Americans, who pay all the bills, do not reside and yet now very much have come to resent.

Put another way fellas, as the young Mr. Jagger, far the more poetical and direct than we, led us in with his Tumblin’ Dice, we’ll just let him lead as back out as well:

“Hunney, I got no money..

You give me 6s and 7s and 9s.”

The message guys is that 6s and 7s and 9s ain’t enough to make a meal from scraps and, as Mr. Jagger likewise sang, still earlier in his career, this ballad:

You cain’t always git what you want, beba…

..And, you cannot always satisfy your greed, hunney….

It�s hard to find knowledgeable people on this topic, but you sound like you know what you�re talking about! Thanks

It is awful confusing here in wonderland